Some residents have said they were surprised there was nothing in the 2024 Budget about pensions. And in one sense they’re right - because the two main decisions had already been announced earlier:

- Increasing the State Pension by 8.5% on the 8th April.

- Maintaining the Triple Lock

Let me focus on these points in turn.

...but two confessions first:

First, I used to run a pensions business. There is a hell of a lot of jargon in pensions and if I’m guilty of that here just ask me to explain - as Einstein said: ‘if I can’t explain this to my grandmother I don’t understand it myself’.

Secondly, I was probably the strongest supporter of the introduction of the Triple Lock in 2010-11 when it came before the Work & Pensions Select Committee, and also of the Auto-enrolment Scheme that has brought 12 million into pension savings. But that doesn’t mean I get everything on pensions right: and situations change, so it’s always best to get personal advice on the detail.

After the disclaimer, now back to the general situation on pensions, and how they’ve fared.

Increasing the State Pension

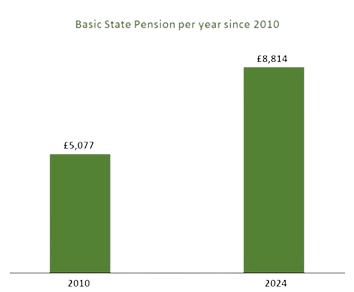

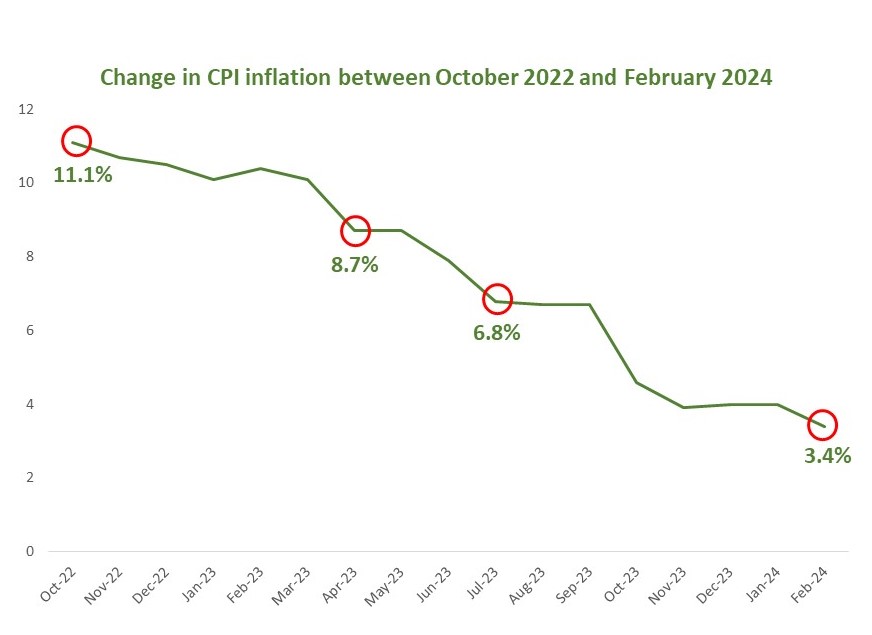

An 8.5% increase in the State Pension (£900 more a year) – the highest figure on record (not including the special pandemic extra payment) - means the basic state pension has gone up £3,733 since 2010. Meanwhile inflation has fallen to 3.4% (March 2024).

- The basic State Pension will rise by £13.30 to £169.50 a week (for those who reached pension age before 6th April 2016)

- The new State Pension will rise by £17.35 to £221.20 a week (for men born on or after 6 April 1951 or a woman born on or after 6 April 1953 with at least 10 years NI contributions)

Whilst pensions have increased, inflation has been halved and continues to fall

The £900 per year increase in pension is the same as the £900 of tax saved this year by workers on the average salary from 4% government cuts to National Insurance.

Half came at the last Autumn Statement (which became effective in January) and half in the recent Budget (effective this 6th April). This doesn’t impact pensioners because NI is a tax on work not retirement.

The key point is that both workers and pensioners are seeing good income increases.

And those on the National Living Wage have also seen a jump in their earnings - up 9.8% to £11.44 an hour.

So whether the state pension, the National Living Wage or every worker paying National Insurance (NI) things are better.

Maintaining the Triple Lock

Because of the link to the highest of either inflation, wages or a 2.5% increase, the State Pension increased by 10.1% last year and 8.5% this year (2024-25). This means that the basic State Pension is nearly £800 a year higher than if pensions had been uprated by either wages or Consumer Price Index (CPI) inflation alone since the introduction of the Triple Lock in 2011, and as a result the value of the State Pension relative to wages has now reached a level not seen since 1980. It’s at a 44 year high, relatively.

Other help for pensioners.

Meanwhile, around 12 million Winter Fuel Payments and Pensioner Cost of Living Payments have provided vulnerable households with up to £600 to help with energy bills which will start to fall in April, offering greater financial flexibility.

Applications for Pension Credit have also greatly increased by 73% over the last 12 months, allowing vulnerable pensioners access to much-needed support including up to £3,300, NHS dental treatment and a free TV license for over 75s.

Gloucester’s pensioners, including our poets, have been boosted by the increased tax free allowance and the Triple Lock

Haven’t more people been “sucked into” paying income tax on their pensions?

Pensions – a form of saving – vary in who contributes what (state/employer/individual), whether the investment risk is taken by the individual (Defined Contribution) or the pension scheme (Defined Benefit) – or a hybrid of the two.

And they differ in tax on the three elements: is the amount you pay put in pre- or post- tax; are the dividends taxed or rolled up free of tax; and is the result (your income) then taxed or not?

In the UK, most savings as a pension are free or exempt of tax, but the income (like all income) is taxed.

Other pools of savings (like ISAs) are the opposite: your savings come out of taxed income, but you can later cash them in tax free.

So pension incomes have grown, and with the increased post-2010 pension allowance (raised year by year, now at £12,570), inevitably those who also have employer pensions do get sucked into tax on incomes between £12,571 and £50,270: which attracts 20% tax and any income over £50,271 gets taxed 40%.

But it’s worth remembering this is only 20% or 40% of the relevant parts of your pension. The tax-

free element remains tax free whatever you earn - only the higher elements are caught. So although

you may pay 20% on part of your income, or even 40%, you are still keeping the lion’s share of an increased pension.

So to recap, you:

- Get an increase this year of £900 on the basic State Pension

- If your pension is between £12,571 and £50,270 then you pay 20% tax on that part of your pension – but keep the other 80% so you will always be much better off having saved more

What does this mean for you?

Over the last few years, pensioners have seen the greatest increase to their pensions since the 1980s with high levels of support for bills and access to other services, and greater financial flexibility for the most vulnerable pensioner households.

Best regards

P.S. I know pensions are complicated and important so if you have any questions please do email me on [email protected]